Businesses operating in high-risk industries or those with less than stellar credit histories may require a high risk merchant account. This account allows these businesses to process customer payments, albeit with higher fees and increased scrutiny due to the inherent risk. But, how can businesses work with these accounts to mitigate risk effectively and secure their legal foundations?

Decoding High Risk Merchant Accounts

High risk merchant accounts are special accounts assigned to businesses that are deemed risky by financial entities. The ‘risk’ tag comes from several factors like the potential for high-value chargebacks, overseas transactions, or a poor credit history.

Here are instances where you might need a high risk merchant account:

- Monthly sales over £15,000

- Average credit card transaction value exceeds £400

- Requirement to accept multiple currencies

- Poor credit history or lack of it

- Predominantly digital transactions (software, tickets, or bookings)

- History of chargebacks

Industries like antiques, car dealerships, ticketing services, brokerages, consultancy services, and music/software downloads are often considered high-risk. Businesses in these sectors should take special care when considering their merchant account options.

Choosing the Right High Risk Merchant Account

The market offers various high-risk merchant account providers, but it’s vital to choose the one that fits your business model best. Here are a few key parameters to consider:

- Fees: Make sure to identify any hidden costs and check if the pricing structure suits your business. Use scenarios to understand how fees would apply.

- Monthly vs pay-as-you-go: Depending on the transaction volumes, consider whether a monthly or pay-as-you-go plan suits your business.

- Payment transfer time: Note the period it takes for funds to be transferred from the merchant account to your bank—an important factor for cash flow management.

When considering high risk merchant account fees, be prepared for:

- Merchant account fees: Typically £100 - £700 per year for in-person and online transactions

- Transaction fees: 1.25% - 2.75% per transaction

- Payment gateway charges: Around £20/month for online transactions

- Making international transactions: Approximately 0.5% - 2%

Legal Considerations for High Risk Merchant Accounts

When dealing with high risk merchant accounts, accepting multiple currencies and transacting in countries that are considered high-risk, a sound legal regime is paramount. Having a strong focus on monitoring and adherence to local and international laws can drastically reduce the risk of chargebacks or fraud.

Ensure that the services or products you offer are legally compliant in countries where you conduct business. Also, be prepared with effective measures to assess and counter potential high risk transactions, which typically means investing in effective fraud detection and prevention mechanisms.

The Conclusion

The process of opening a high risk merchant account can be challenging, but it is essential for businesses in certain sectors to navigate the world of commerce effectively. The right account can help businesses improve their credit history, conduct business in a high risk region, or operate in a lucrative high-risk industry.

Nevertheless, a focus on strong legal foundations, risk monitoring, adherence to local laws, and fraud prevention provides a safe framework to operate these accounts. Seeking assistance from lawyers or specialized legal services is a good practice to mitigate risks and keep the business within legal boundaries.

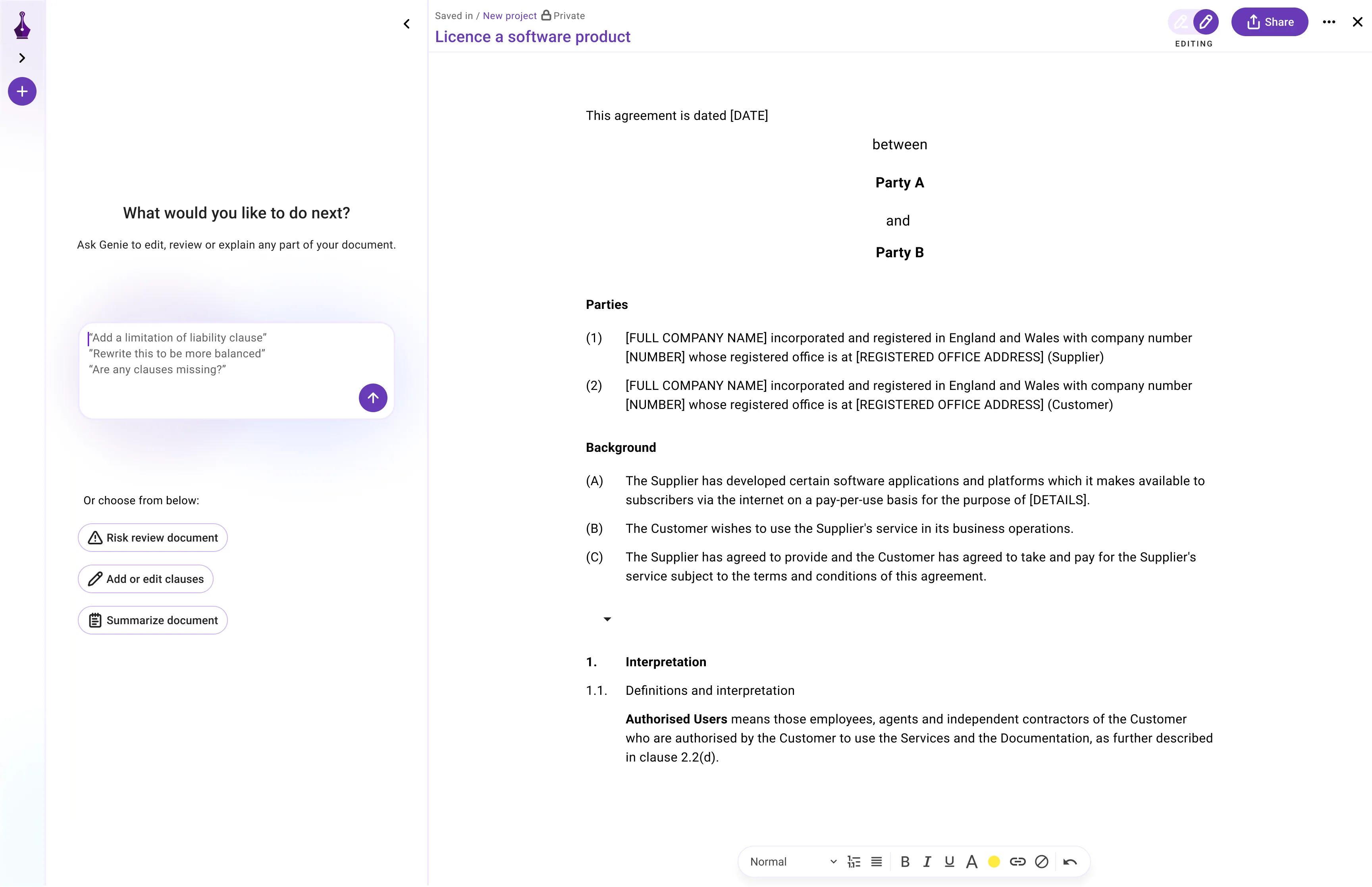

For drafting, reviewing, negotiating, and signing of legal agreements, consider using legal tech tools. Sign up to Genie AI, an AI Legal Assistant that helps businesses navigate through complex legal procedures. Utilize this technology to reduce risk, improve your business’s legal foundations, and to solidify your journey through high risk merchant accounts.

.png)

.png)