-and-enterprise-investment-scheme-(eis)-image.jpeg)

SEIS and EIS: Unlocking Investor Incentives and Fueling Your Startup

Startups and scaleups represent unique investment opportunities; however, the associated risks could deter investors. That’s where the Seed Enterprise Investment Scheme SEIS and the Enterprise Investment Scheme EIS come into the picture.

These government initiatives encourage private investors to fund fledgling UK businesses by providing generous tax breaks.

1. SEIS Explained

The SEIS aims to facilitate startups in their early stages. With SEIS, an investor gets a 50% tax break on investments up to £200,000 per tax year. However, your startup has to tick specific boxes to be eligible.

Eligibility criteria for SEIS:

- Your company has been trading for less than three years.

- It’s incorporated and not trading on a public stock exchange in the UK.

- Your company has less than £350,000 in gross assets.

- No more than 25 full-time employees are engaged.

- Your company cannot accept any EIS investments before.

- Neither has your company ever received investment from a venture capital trust.

- Your company should not control another company unless it’s a qualifying subsidiary.

- Your company should not be controlled by another company.

With these criteria met, your enterprise can receive a maximum of £250,000 in funding through SEIS.

2. EIS Explained

For slightly more established companies, the EIS provides benefits. Investors receive a 30% tax break on up to £1 million they invest through EIS every tax year (rising to £2 million if they invest in knowledge-intensive companies (KICs)).

Eligibility criteria for EIS:

- The company has been trading for less than seven years (exceptions are possible).

- Your company is established and not trading on a public stock exchange in the UK.

- Your company has less than £15 million in gross assets.

- Your company engages fewer than 250 full-time employees.

- Your company doesn’t control any other company barring qualifying subsidiaries.

- Neither does another company control your company, nor does another company own more than 50% of its shares.

- Your company should not plan to close after completing a project or series of projects.

With EIS, depending on your business type, you’re eligible for a £12-20 million investment.

Essential Detour: Qualifying Trades

The eligibility of SEIS and EIS also hinges on the nature of your business. Your business needs to carry out what HMRC calls a “qualifying trade.” If the following ‘trades’ account for less than 20% of your business, then you’re all good:

- Coal or steel production

- Farming or market gardening

- Leasing activities

- Legal or financial services

- Property development

- Running a hotel

- Running a nursing home

- Generation of energy

- Production of gas or other fuel

- Exporting electricity

- Banking, insurance, debt, or financing services

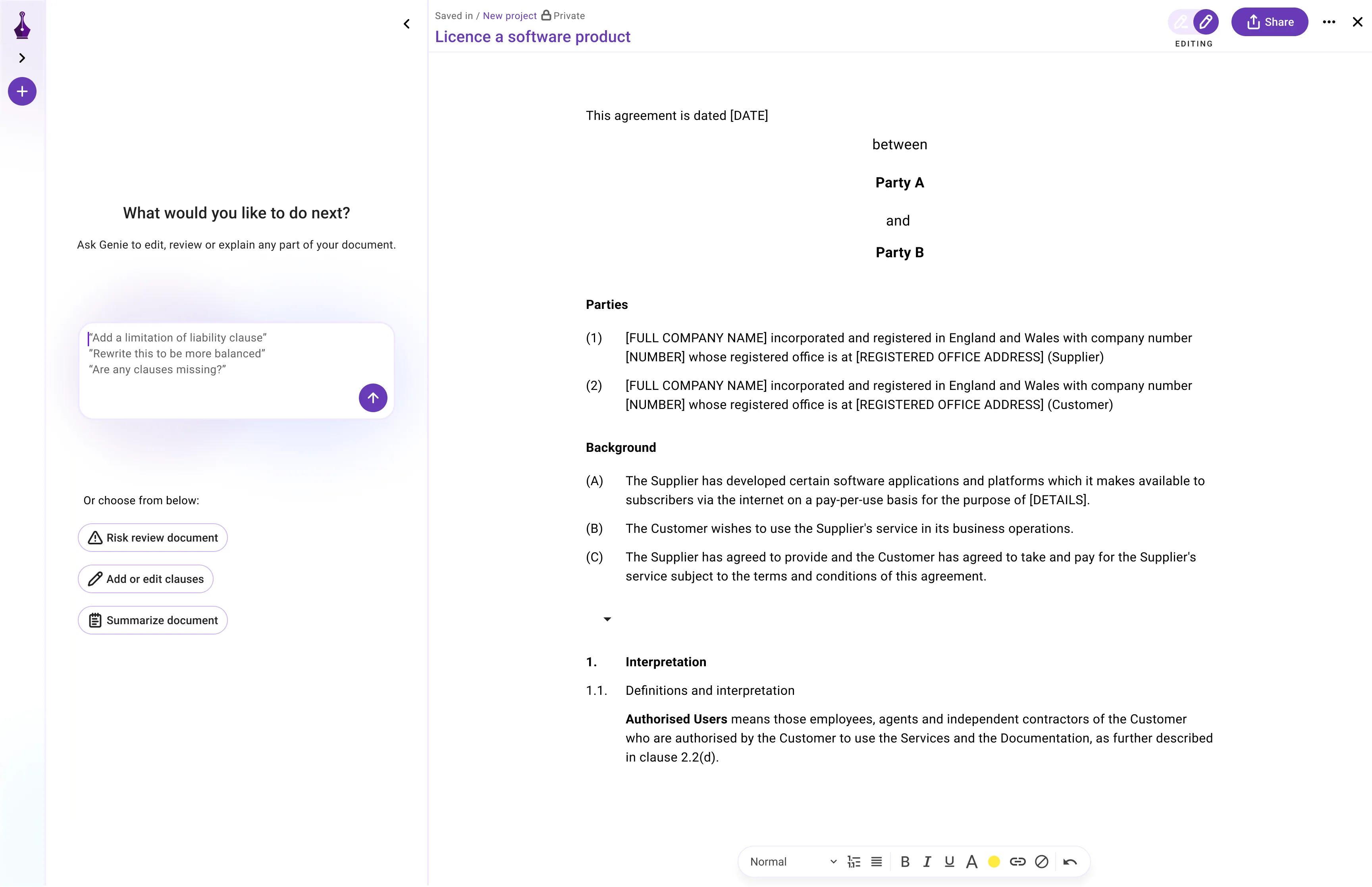

3. Advanced Assurance: Safeguarding Investments

While you take the initiative to qualify for SEIS and EIS, potential investors like to be certain about their tax relief. The SEIS and EIS advanced assurance cater to this security. Advanced assurance allows you to check with HMRC that your startup qualifies for these schemes before you apply. Unlike a final verdict, this assurance is akin to having a mortgage in principle from a bank.

When applying for advanced assurance, you’ll be answering several questions about your company, your business plan, and how you plan to use the money raised.

Having this preliminary check can save you from potentially being denied after applying. Additionally, it ensures that investors get the guaranteed tax benefits of their SEIS or EIS investment.

4. Diving Into Investor Benefits

SEIS and EIS offer multiple tax benefits to investors as long as they adhere to the rules:

- Income tax relief: Investors can claim back 50% on up to £200,000 in SEIS investments per tax year, and 30% of up to £1-2 million in EIS investments.

- Capital Gains Tax (CGT) relief: Profits made when they sell your company’s SEIS or EIS shares are exempt from CGT (as long as they’ve held their shares for three years).

- Loss relief: Investors can claim loss relief equal to their income tax bracket on any money they lose investing in your company through SEIS or EIS.

- Capital Gains reinvestment relief: 50% of capital gains are exempt from CGT if they’re re-invested in an SEIS/EIS-eligible business.

Almost anyone can make investments under SEIS and EIS (excluding certain family members) as long as they stick to the rules. But specific exceptions apply to employees, the entrepreneur’s spouse (or civil partner), parents, grandparents, children, and grandchildren, as well as anyone owning 30% or more shares in the company or voting control.

5. The Pertinent Legal Consideration

SEIS and EIS have legal implications as they require government approval. You need to ensure your application meets all the markup points to gain the license. This approval also has prerequisites on funds usage. The funds you raise through these schemes could be expended on expanding your company (like recruiting new employees or marketing your business) or R&D to boost growth. Furthermore, the SEIS funds must be spent within three years and the EIS funds within two.

6. Conclusion: Reducing Risk and Leveraging SEIS and EIS

Pondering a funding round? Applying for SEIS and EIS should be on your checklist. SEIS and EIS not only pump up your startup with the cash needed, but they also incentivize investors with appealing tax breaks. It’s a win-win! Hence, embrace these schemes, boost your startup’s growth, and help investors realize their financial goals.

Don’t forget, though, the legal implications of these schemes are deep and wide-ranging. It’s imperative to have a robust legal foundation to navigate through SEIS and EIS and reduce any associated risk. Genie AI’s artificial intelligence-powered Legal Assistant can be your guide in drafting, reviewing, negotiating, and signing legal agreements. It offers a vast resource of knowledge and is custom-built to aid your journey towards lawful prosperity. Sign up to Genie AI and enhance your business’s legal foundation today!

.png)

.png)